As TikTok continues to dominate the social media landscape, it has evolved from a platform for short-form video content into a bustling marketplace with TikTok Shop. Sellers are leveraging TikTok Shop’s massive user base to reach new customers and expand their businesses. However, with this opportunity comes the complexity of navigating the various fees associated with selling on the TikTok Shop platform. In this article, we will take a comprehensive look at the different TikTok Shop seller fees, breaking down what they are, how they work, and what TikTok Shop sellers need to know to maximize their profits while minimizing costs. Whether you’re a seasoned TikTok seller or just starting out, this deep dive will equip you with the essential knowledge to thrive in the TikTok Shop marketplace. If you’re interested in comparing the fees on TikTok and other major marketplaces, check out our Fee Comparison Between Amazon, Facebook Shopping, and TikTok Shop.

A Quick Overview of TikTok Shop Seller Fees

One of the first questions that arise when you decide to join TikTok Shop is – how much does TikTok charge businesses for selling through the platform? The answer is – you need to pay a little something to sell through TikTok Shop.

Primarily, these TikTok Shop Fees include:

- Referral fee

- Chargeback fees

- Affiliate commission fee

- Affiliate Partner commission fee

And then there are other fees and adjustments. Businesses also need to keep in mind the shipping and handling costs. If they have the logistic capacities, they can handle these by themselves. Alternatively, these can be managed through TikTok’s own network of logistics services.

While all these fees may seem like a lot, there are a couple of things to bear in mind. First of all, not all of the fees apply to all sales, as we will see shortly.

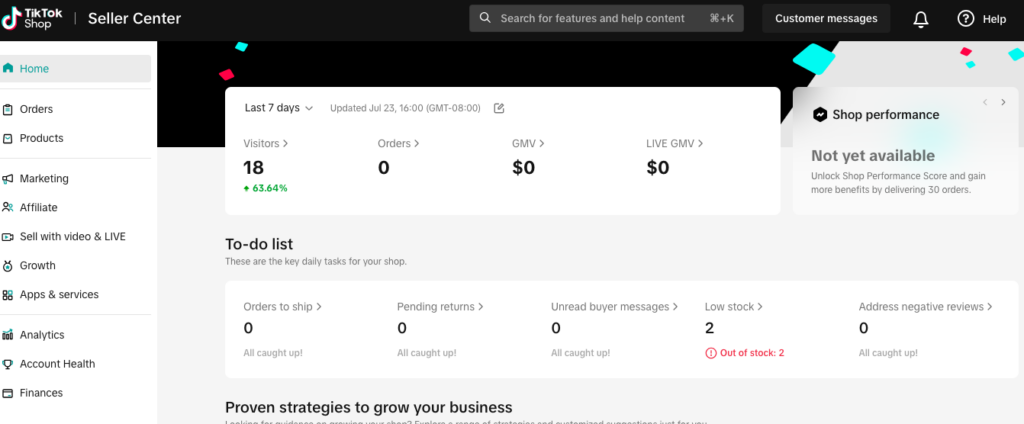

Also, in order to lower the entry barriers and engage sellers to sell through TikTok Shop, the platform offers new seller promotions which include reduced referral fees. Finally, note that the platform automatically calculates and remits sales taxes, depending on the local tax laws of the market you’re operating in.

Let’s dig in!

Referral Fee

The most important TikTok Shop seller fee for businesses in the USA is the Referral Fee.

This is a fee that encompasses all seller fees for US transactions, which means it includes both the marketplace fee and the transaction fee.

Referral Fee is defined by TikTok as a fee charged to sellers on all qualified transactions. And by “qualified transactions” they mean orders that have been completed. The GMV is calculated as what the buyer paid plus platform discount minus tax. This is then multiplied by the fee rate.

The formula is:

(Customer payment + Platform discount – Tax) x Fee rate = Referral Fee

And this brings us to the most important part – the fee rate.

The current TikTok Shop Referral Fee rate is 6%. It is a flat fee that doesn’t depend on the product category.

Note that TikTok Shop refunds the Referral Fee in case of any refunded or returned orders. However, a Refund Administration Fee applies, and it is 20% of the Referral Fee.

Chargeback Fee

A chargeback occurs when a customer disputes a transaction and requests a refund from their financial institution. Common reasons for chargebacks include non-receipt of the order, discrepancies with the product listing, damaged items, billing errors, duplicate charges, and suspected fraudulent transactions.

When a shop receives a chargeback, TikTok Shop’s third-party payment processor contacts TikTok Shop for transaction details. Sellers are notified through Seller Center if additional information is needed, which must be provided within a specified timeframe. TikTok Shop covers the costs for orders labeled as “Unauthorized Payment” by financial institutions. However, sellers remain liable for losses and fees associated with suspicious activity chargebacks.

Appealing a chargeback costs $10 per instance, plus any applicable taxes. If the required information is provided and the chargeback is deemed “Unauthorized Payment,” the seller is not charged the appeal fee, and TikTok Shop does not collect the chargeback amount from their account.

Affiliate Commission Fee

TikTok Shop sellers have the opportunity to boost their sales by partnering with selected creators through the TikTok Shop Affiliate Program. In this context, an Affiliate is a TikTok creator who collaborates with sellers to market and sell their products. For each successful sale made via the Affiliate, sellers pay a commission fee determined by the agreed-upon Affiliate Commission Rate. This arrangement is facilitated through the Affiliate Plan, which is set up within the TikTok Shop Affiliate Marketing module.

The seller decides which rate to apply for which products. When stipulating the arrangement, the Affiliate and the Seller agree upon the products that will be promoted and the commission rate that will apply for each sale of that product.

The Affiliate Commission Fee is calculated based on the item price, minus discounts, and shipping and tax fees are, again, not included.

The formula for calculating the Affiliate Commission Fee is:

(Item price – TikTok Shop discount – Seller discount) x Affiliate Commission Rate = Affiliate Commission Fee

Let’s say an affiliate helps sell a $40 makeup set, the seller approves a 10% discount and the commission rate is 10%. The Affiliate Commission Fee the seller will have to pay to the affiliate will be (40-4) x 10% = $3.6.

Affiliate Partner Commission

An Affiliate Partner on TikTok Shop connects scalable creators with sellers to enhance efficiency and optimize collaborations. The commission structure for Affiliate Partners is determined by the TikTok Shp Sellers. For example, if a Seller sets a 15% commission for the Affiliate Partner and 10% for the creator, the Affiliate Partner earns 15% of the sales generated through their product links, while the creator earns 10%. This would mean that in this example the total commission fee paid would be 25% of the purchase amount on an affiliate driven sale.

In cases where a creator has a commission-sharing agreement with a Multi-Channel Network (MCN), the creator’s commission is shared according to the agreed rate. For instance, if the total commission is 20%, with 10% allocated to both the Affiliate Partner and the creator, and the creator shares 50% of their commission with the MCN, the creator would receive 5%, and the MCN would get the other 5%.

This flexible commission structure allows Affiliate Partners to effectively promote products and earn based on the sales generated by the creators they collaborate with.

TikTok Platform Penalty

After identifying a violation of platform policies, TikTok will deduct a corresponding penalty amount from the seller’s account. Details about the violation and the corresponding penalty will be sent to the seller’s email address.

Sales Tax

You’ve probably noticed that, for each of these fees, we stressed that it does not include shipping or tax. As for shipping costs, they are either handled by the business through their own or third-party logistics services, or through the TikTok Shop’s Logistics Partner Platform. Since this is a cost that a seller is well aware of having to incur when doing eCommerce, we won’t get into the details of these costs.

Sales tax, however, is something a lot of new TikTok Shop sellers are curious about.

Like with most eCommerce platforms, tax policies are determined by the tax laws that apply in the buyers’ local jurisdictions. That means that sellers need to set up their accounts in the Seller Center so they include tax collection, as the sales tax is borne by the buyer. In general, this also means including the TRN (Tax Registration Number) of the business or a similar applicable tax identifier.

Fortunately, eCommerce platforms like TikTok Shop usually have automatic calculators that calculate the tax based on the buyer’s location, as well as the type of item that is sold. In the USA, TikTok Shop as a marketplace facilitator is legally required to calculate, charge, collect, and remit all applicable sales taxes to the tax authority. This means that TikTok Shop collects the applicable sales tax and then pays that sales tax to the appropriate tax authority.

Wrapping It Up

Figuring out the costs associated with selling on TikTok Shop can seem difficult but, as we saw, it’s not that intricate after all. Understanding these fees and how they impact your business is crucial for maximizing profitability on the platform. By leveraging TikTok’s vast user base and strategic marketing opportunities, sellers can significantly expand their reach and boost sales.

For those ready to take the next step, GrowMojo is here to help. As an official TikTok Shop partner, GrowMojo offers the expertise and support you need to start selling successfully on TikTok Shop. Reach out to us today and let us guide you through the process, ensuring you make the most of this dynamic marketplace.